Crude from Manifa will provide feedstock to two refineries

Crude from Manifa will provide feedstock to two refineries

SAUDI ARABIA has more spare oil production capacity than is required by government directive and has no immediate plans to raise capacity beyond the current 12.5 million barrels per day (mbpd), though it could bring on new projects within three to four years should it need to maintain or raise capacity, Saudi Aramco CEO Khalid Al Falih says.

Saudi Aramco is focusing on developing its conventional natural gas reserves in the short to medium terms and its non-conventional gas reserves in the longer term while investing in the expansion of its downstream, petrochemicals and chemicals projects, he says.

“We’ve said many times before that Saudi Aramco, with 260 billion barrels plus of reserves, proven...has already archived a number of projects which we can bring to offset the decline or if we were asked to increase capacity,” Al Falih says, adding that the company has “a rich portfolio of projects.”

“But today, Saudi Aramco has more spare capacity than the kingdom is obligated or has committed to do, which is 1.5 to 2 mbpd. So we have spare capacity in excess of the government’s policy directives,” he adds.

There are “plenty of other suppliers, companies, regions and basins that are bringing on production and can help to meet rising supply from China and developing Asia as well as the Middle East,” he adds.

Saudi Oil Minister Ali Al Naimi said several years ago that Saudi Arabia had identified the fields that could be brought online to raise total production capacity to 15 mbpd should there be a need to do so.

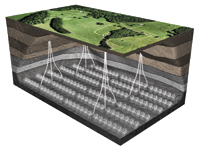

The latest increment will come from the Manifa offshore heavy oil field, but Falih says there is no decision yet to produce the full 1.2 mbpd capacity from the field.

US oil services company Halliburton says it is increasing activity at Manifa following discussions with Saudi Aramco, an indication the kingdom was stepping up efforts to bring on its final planned capacity increment.

Saudi Aramco last year slowed down the Manifa project, designed to offset natural declines in other fields, because of anticipated weaker demand for its crude.

Crude from Manifa will provide feedstock for two planned refineries at Yanbu and Jubail, each with capacity to process 400,000 bpd, as part of the kingdom’s plan to free up lighter grades for export.

Speaking earlier at an Energy Dialog conference to launch the King Abdullah Petroleum and Science Center (KAPSARC) think tank in Riyadh, Al Falih said there was less pressure now on Saudi Arabia to raise production beyond its immediate needs.

“Given the increased availability and distribution of oil reserves, I think there was pressure on the kingdom and on Saudi Arabia to raise production beyond the needs of Saudi Arabia. That pressure I would see is substantially reduced,” Al Falih says.

“Our focus is to invest heavily in gas, in downstream, in refining and, something that is new to Aramco, in chemicals,” Al Falih says, adding that this would provide the state-owned company a global footprint.

The scale of projects that Saudi Aramco is undertaking in China, South Korea as well as mega projects in the downstream at home “are equal to and sometimes eclipse what we are doing in the upstream,” he adds.

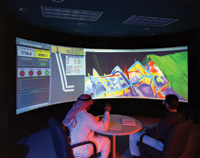

Saudi Aramco also is planning to develop its shale gas resources in the future and plans to drill a number of wells this year to test the geology of the wells and conduct preliminary economic models, Al Falih says: “We will continue that in 2012.”

.jpg)