PDO ... maximising output

PDO ... maximising output

Under the current difficult circumstances, PDO has been focusing its attention on primary and secondary production, while paring back its previously stated targets for output from costly tertiary or EOR projects

Oil producers in Oman are feeling the pinch as oil prices remain in the doldrums. The country has some of the highest production costs in the Middle East, with a mature resource base that increasingly requires complex and expensive extraction technology.

This makes it an interesting case study within the region because its geology has forced it to innovate and utilise techniques that its neighbours will undoubtedly have to turn to in time as their assets mature.

"We don’t have the luxury of our neighbors in terms of resources available for development. We have and always have been fighting Mother Nature, if you like: our geological complexity," Oil Minister Mohammed Al-Rumhy told a recent Society of Petroleum Engineers (SPE) conference in Muscat.

Despite the challenges it faces, Oman has not cut back its production, which has actually risen to new highs. Oil output surpassed 1 million barrels per day in December and held steady at that level into February. Al-Rumhy has pegged the sultanate’s overall production costs at $27 per barrel, including $10/bbl in day-to-day operating costs.

For comparison, Saudi Arabia, Kuwait, Iran, Iraq and Abu Dhabi say almost all of their production costs less than $10/bbl, with most of it costing just a few dollars.

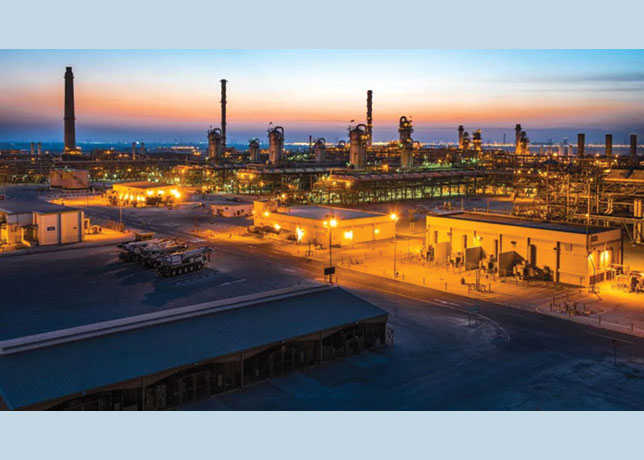

Petroleum Development Oman (PDO) – the state-controlled producer which accounts for over 60 per cent of the country’s oil output – has been the main architect of a strategy to maximise output and has taken the lead in enhanced oil recovery (EOR) projects that utilise new and innovative technologies.

But because the government is the dominant shareholder in PDO – stakes are also held by Royal Dutch Shell (34 per cent), Total (4 per cent) and Partex (2 per cent) – the slump in oil prices has required the company to perform a delicate balancing act.

On the one hand it has an obligation to contribute to the nation’s welfare and development by providing jobs and training, and on the other it also needs to reduce costs while maximising production and revenues.

Under the current difficult circumstances, PDO has been focusing its attention on primary and secondary production, while paring back its previously stated targets for output from costly tertiary or EOR projects. Although enhanced recovery will inevitably remain a substantial part of PDO’s portfolio, the emphasis now is on producing as much oil as possible from lower-cost sources.

PDO produces about 600,000 bpd of oil, of which 4 per cent comes from tertiary sources, 52 per cent from secondary and 44 per cent from primary, according to its managing director, Raoul Restucci.

Speaking at an oil ministry media briefing in Muscat in late March, Restucci put the average cost of the company’s primary production at just $5/bbl, with secondary production at $12/bbl and tertiary at $25/bbl. He also says he would not be surprised if the share of tertiary oil in the company’s total output started to decline in the near future as a consequence of low oil prices. And if PDO is scaling back on tertiary recovery projects, then it’s a fairly safe bet that smaller producers will do so too.

Restucci now expects that by 2025 only around 28 per cent of PDO’s output will come from tertiary recovery projects, down from the 33 per cent that he had predicted a year earlier.

Primary and secondary output are expected to account for 34 per cent and 38 per cent, respectively. The revised numbers are based on the assumption of exploration success and improved output from existing fields, which would still enable PDO to meet its 600,000 bpd plateau target, despite a smaller contribution from EOR.

"Tertiary is effective, works extremely well, but it’s higher cost – polymer injection, the chemicals, the solvents, steam," he explained.

Al-Rumhy has played down the impact of low oil prices, saying, for example, that the giant Mukhaizna heavy oil project – operated by Occidental – was "still profitable" and "making us some money" at prices in the $30-$40 range.

Nevertheless, he acknowledged that "to launch a new project today would probably be challenging."

Occidental holds a 45 per cent stake in Mukhaizna, while state-owned Oman Oil Co. holds 20 per cent, Shell has 17 per cent, Liwa 15 per cent, Total 2 per cent and Partex 1 per cent.

The project averaged gross daily production of 122,000 barrels of oil equivalent per day in 2015, representing more than 10 per cent of the country’s output, according to Oxy’s regulatory filings in the US.

Industry sources had pegged Mukhaizna’s production costs at around $60/bbl last year, but says that work was under way to bring them down.

Low oil prices have certainly put pressure on contractors to make price concessions and producers have also been looking at every possible way to cut their spending and lower costs. So operating costs have certainly fallen dramatically, but it remains difficult to quantify that fall.

Oxy’s country manager Robert Swain confirms that recent price levels are "bearable" for Mukhaizna but adds that "the challenge is how much additional capital investment, depending on the oil price, you can bear."

Despite his claims that Oman’s oil is still profitable at today’s prices, Al-Rumhy has consistently urged producing nations to agree to limit their output in order to stabilise prices.

He has even gone a step further, advocating a production cut of 5 per cent to 10 per cent, noting that would amount to a reduction of 90,000-100,000 bpd for Oman.

Given the government’s controlling stake in PDO, he says implementing such a cut would be a relatively easy matter. However, he made clear that the sultanate would only take such action as part of a wide-ranging agreement with other producers.

Meanwhile, the minister lays the blame for the current low level of prices squarely at Opec’s door. "There is more supply than demand. I would say it’s not an acceptable thing to produce 1 mbpd and sell for $20-$30/bbl, instead of producing 500,000 and selling it for $100/bbl," he says at the SPE conference.