On January 2, the Saudi chemical juggernaut signed a heads of agreement with South Louisiana Methanol

Saudi chemical company Sabic is looking for opportunities in the US, Mohammed Al-Hazmi, a director at the company says.

"Sabic is looking for cheap feedstock, but the business case will have to be strong to be justified", he told an audience at ME-TECH 2019 conference, which was taking place on 26-28 February in Abu Dhabi.

Like state-owned Saudi Aramco, it relies on an abundant and cheap supply of gas to produce high-value petrochemicals.

But lavish domestic energy subsidies are diverting large gas volumes toward residential and commercial use, with a difficult equation to solve for the kingdom if it wants to satisfy those two competing sources of demand.

Cheap US gas is hence attractive for a company like Sabic, especially in light of the company’s recent technological partnerships.

Earlier this month, the company signed a joint development agreement with Italy’s Eni to develop natural gas conversion into synthesis gas that can be further processed into higher-value fuels such as methanol.

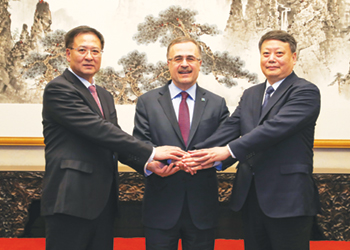

On January 2 this year, the Saudi chemical juggernaut also signed a heads of agreement with South Louisiana Methanol to precisely develop a methanol facility in the US.

Sabic is the world’s fourth-largest chemical company and has crystallised the attention of Saudi Aramco, in a bid to combine forces to create higher-value products rather than having to compete on the same downstream segment.

Aramco’s CEO Amin Nasser says that a decision on how to fund the acquisition of Sabic would be taken by the first half of 2019.

In the meantime, several reports indicated that at least four investments banks had been appointed by the Saudi company in relation to a possible bond/debt issuance.

Sabic is 70 per cent owned by Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), while the remaining 30 per cent is owned by private investors from the six GCC countries.

Purchasing the stake from the PIF could represent a $70 billion buyout for Aramco, a source recently told ICIS, even if no final price has been formally agreed yet.

Both companies formally sealed their alliance on 1 November 2018, when Yanbu on Saudi Arabia’s east coast was chosen as the site of a joint 400,000 bpd crude-oil-to-chemicals (COTC) complex.

The plant is expected to come on line in 2025 and will produce 9m tpy of chemicals and base oils.