Kufpec ... seeking buyouts

Kufpec ... seeking buyouts

The targets for Kufpec were set after a recent strategic review of government-owned KPC and its subsidiaries. Kuwait had also considered merging Kufpec with another entity but eventually decided to keep it as a standalone company

Kuwait Foreign Petroleum Exploration Co (Kufpec) – the international upstream subsidiary of Kuwait Petroleum Co (KPC) – is looking to make at least one sizeable upstream acquisition that would lift its production to 150,000 barrels of oil equivalent per day by 2020 from around 110,000-115,000 boepd today.

"We want to get to 150,000 [boepd] by 2020 and maintain that until 2040," CEO Nawaf Al-Sabah says. Plans also call for maintaining reserves at around 12 years’ worth of annual production.

"This is about 650 million [boe] in terms of reserves. And we want to maintain that flat, so we have to continue to replace production on a yearly basis."

The targets for Kufpec were set after a recent strategic review of government-owned KPC and its subsidiaries. Kuwait had also considered merging Kufpec with another entity but eventually decided to keep it as a standalone company.

Kufpec’s portfolio spans 14 nations including Pakistan, Canada, Indonesia, Egypt, Norway and Australia, where it holds an 8 per cent stake in the Chevron-operated Wheatstone LNG project. It plans to conclude at least one significant upstream deal in one of its existing markets.

If the company were to venture into a new country, it would have to be via a large acquisition that would add materially to its production, Al Sabah added. Pakistan, Australia and Norway, are the favored markets for expansion, and the company is in talks about various potential deals.

"We’re the second-largest international company in Pakistan, and my challenge to our team there is to be the first," Al Sabah says.

Kufpec is also making a push to develop expertise in unconventional oil and gas. Kuwait has considerable shale resources that it is not currently developing, but will likely be developed in the future. The company is aiming to put itself in a position where it has knowledge and expertise that it can transfer to Kuwait Oil Company, the Mideast Gulf state’s domestic upstream company, Al Sabah says.

The company has a 30 per cent stake in the Chevron-operated Kaybob Duvernay shale gas project in Alberta, Canada, and is looking at other potential acquisitions in the shale space.

This could include a major discovery announced by Bahrain earlier this year. "For us Bahrain makes a lot of sense because it’s a place where Kuwait has invested successfully for generations," Al Sabah notes. "We are looking at all the options right now and are categorizing what we want to pursue in the next few months."

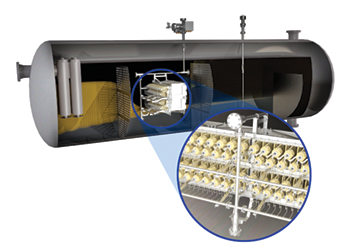

LNG is also central to the company’s strategy. Kufpec nets 39,000 boepd from the Wheatstone project and this will increase by another few thousand barrels when it starts supplying gas to Australia’s domestic market within a couple of months. While Kufpec’s share of the LNG is sold in the international market, half of the sales contracts have clauses that would allow Kufpec to ship the gas back to Kuwait, if needed there. Kuwait is currently importing LNG at prices that are lower than Wheatstone’s LNG is being sold for, so it would not make sense to make that change, Al Sabah says.

"At some point in the future we think the markets will change and the situation will flip, so that it will make economic sense for us to supply [Wheatstone] LNG directly to Kuwait," Al Sabah adds.