Brown ... appetite for more

Brown ... appetite for more

ROYAL Dutch Shell has signed a deal with Qatar Petroleum (QP) for the development of an estimated $6.4 billion petrochemical complex in Ras Laffan, deepening the strategic relationship between the two companies at a time when their joint-venture Pearl gas-to-liquids (GTL) project is approaching full capacity.

The heads of agreement was signed between Qatari Energy Minister Mohammed Al Sada and Shell CEO Peter Voser, just as the World Petroleum Congress kicked off in Doha. The agreement follows a joint feasibility study conducted by Shell and QP, the companies say. QP will hold an 80 per cent equity interest in the project, with Shell set to hold the remaining 20 per cent.

“This project has been through the pre-Feed [front-end engineering and design] stage,” Andrew Brown, head of Shell’s Qatar operations, says. Since signing a memorandum of understanding last December, Shell has been “maturing the concept and completing our commercial negotiations with QP,” Brown adds.

Continuing to expand its footprint in Qatar, Shell has found QP to be a solid strategic partner, Brown says. “We do have appetite to do more activities with QP,” he says.

“If you look at the projects that QP is looking to do at the moment, they’re focused on exploration and petrochemicals and we are delighted that we have entered both of those sectors,” he adds.

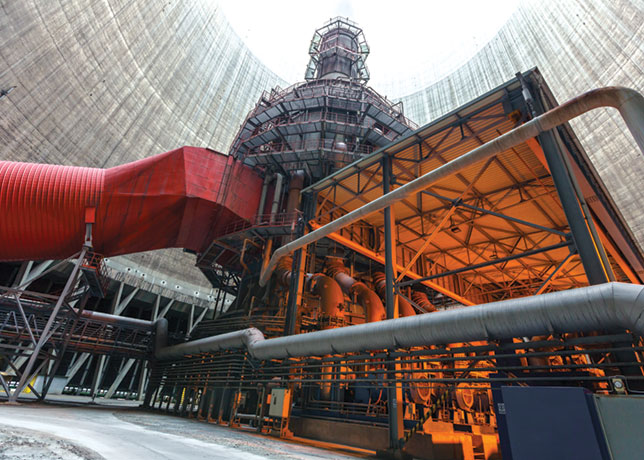

As the largest foreign investor in Qatar, Shell is also partnered with QP on the Pearl GTL project, the world’s largest GTL plant. Once fully operational, Pearl GTL is set to produce 1.6 billion cubic feet per day of gas from Qatar’s North Field, which will be processed to deliver around 260,000 barrels per day of high-quality products. The project is set to produce 120,000 bpd of natural gas liquids and ethane, and around 140,000 bpd of GTL products such as gasoil, diesel and kerosene.

“Phase 1 of this two-phase project has almost reached full capacity,” Brown says. “Phase 2 is starting up,” he adds.

Shell will progressively start up the GTL reactors of Phase 2 and “by the middle of 2012, we will be at full production,” Brown says.

Brown declined to provide current output figures on the project, but said that “we have been running the first phase for a couple of months at quite high throughput, close to full capacity.”

Shell has two of the 12 reactors as part of Phase 2 currently operating, Brown adds.

The Emir of Qatar, Khalifa Al Thani, inaugurated the Pearl facility at a ceremony in Qatar’s Ras Laffan Industrial City.

Pearl’s first production train started operations in the first quarter of this year, while its second unit followed earlier this month by bringing in sour gas from offshore wells. “The wells for phase two are open,” Shell CEO Peter Voser says.

Pearl’s gas processing plant is also online delivering on-spec gas, condensate, LPG and sulphur, Shell says in a statement. The plant’s output is essentially equivalent to refined petroleum products including naphtha, gasoil, kerosene, paraffin and base oil lubricants, all containing exceptionally low concentrations of contaminants such as sulphur, benzene and particulates and therefore expected to fetch premium prices on world markets.

Shell says the plant would broaden Qatar’s options for generating value from gas produced from the vast North Field in the Persian Gulf, which is estimated to contain nearly 900 tcf of reserves. Ranking as the world’s largest conventional hydrocarbon deposit, the North Field is Qatar’s side of a huge gas field shared with Iran, which calls its side of the reservoir South Pars.