Sabic closing its Washington Bottom facility

Sabic closing its Washington Bottom facility

LOCAL officials in the US are assessing the tax impact from the closure of the Sabic Innovative Plastics plant in Washington Bottom.

The company, which pays more than $900,000 annually in taxes, announced the plant will close in 2015.

According to tax records, Sabic owns 600 acres in Washington Bottom, which includes 18 parcels of land. The property includes the plant facilities, buildings and some surrounding property, including land across the road from the plant.

Wood County may see some changes in tax revenue from the plant during the next 18 months, but depending on the condition of the buildings and personal property remaining on the site, the biggest reduction in tax revenue will be in tax year 2016.

Wood County Assessor Rich Shaffer says tax records show the company pays $209,362 in real estate taxes and $704,976 in personal property taxes, based on the current value.

Also, the state announced Odebrecht chose Wood County for an ethane cracker that would be located on the land owned by Sabic, which includes the Tri-C sports facilities next to the plant.

Depending on what remains on the property after Sabic leaves in the form of buildings, machinery and equipment, the value of the property will go down. A land value will remain even if the property is completely vacant, but the levying entities, the municipalities, schools, state and county will see definite tax revenue losses. The schools receive the largest percentage of the tax revenue. The West Virginia State Tax Department does the appraisals for industrial and utility properties, not the local assessor’s office.

Shaffer says it is unknown what changes will occur at the plant over the 18-month transition period that could affect property values.

“Depending on what happens with the buildings and personal property – some of which may be removed – the buildings may or may not still be there, that will obviously affect value,” Shaffer says.

“No timetable was given for the cracker plant, so we don’t know when that might happen,” he says.

Shaffer was among those attending the cracker plant public announcement. “If the (cracker plant) company exercises their option to purchase the land, they may have agreements with the state that would make the new facility completely tax-exempt,” Shaffer says.

Much is speculation at this point, he says.

“With the announcement, I expect, through the crystal ball everyone asks about, we will see some businesses come into the area on speculation, that may offset some of the decrease in value from Sabic,” he says.

Of the real estate, $1,537,000 is attributed to the building itself, Shaffer says of the current appraisal. If the buildings are torn down, the real estate value would be decreased, and it would be appraised for the land value only if it’s sitting there vacant.

“The land value would continue to stay with the real estate and be taxed,” Shaffer says.

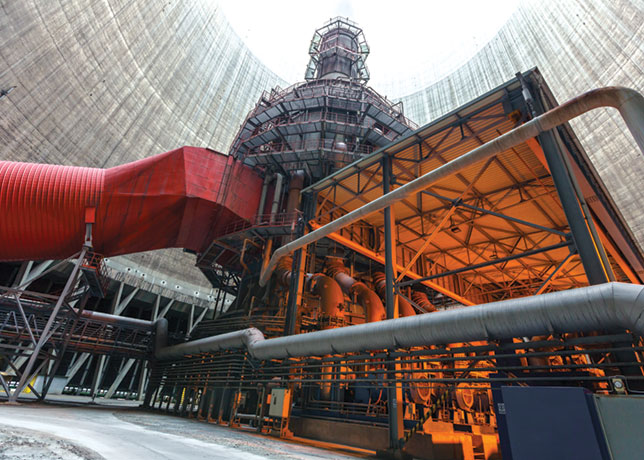

The assessor says many times with industrial sites the larger tax revenue comes from the personal property – things like piping, machinery, equipment and tanks – while the buildings may be field structures with metal sheeting with not a lot of value tied to them. With personal property, companies are required to report annually. Real estate is revalued every three years. State tax officials go in and meet with company officials to determine the list of personal property.