Clariant ... merging parts of business with Sabic

Clariant ... merging parts of business with Sabic

The deal with the Swiss major doesn’t include several well-known Sabic materials that originated with GE Plastics

Swiss materials supplier Clariant AG and Saudi chemicals company Sabic are to merge parts of their businesses in a bid to create a leading supplier of high-performance materials.

The move follows Sabic’s takeover of a 24.99 per cent stake in Clariant earlier this month and builds on the previous successful Catalyst joint venture Scientific Design between the two companies.

The Muttenz, Switzerland-based Clariant announced that it had signed a memorandum of understanding (MoU) with Sabic to combine its additives and high value masterbatches (colour, high temperature resins and health care) with parts of Sabic’s specialities business to create a new joint venture business for high performance materials.

The deal doesn’t include several well-known Sabic materials that originated with GE Plastics. Materials remaining with Sabic include Lexan-brand polycarbonate, Cycolac-brand ABS, Cycoloy-brand PC/ABS, Valox-brand PBT and Xenoy-brand PC/PBT.

A definitive agreement is expected to be signed in the first half of 2019 with the business, which is estimated to create over €3.5 billion in sales by 2021, to be carved out by the end of next year. The new business is set to be effective at the beginning of 2020, subject to regulatory approvals.

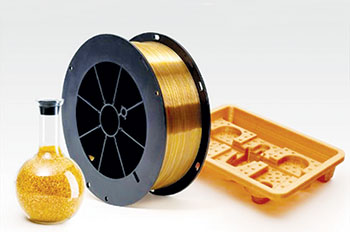

The proposed business will offer a range of high-performance thermoplastics for demanding thermo-electro-optical and mechanical environments, speciality additives and masterbatches.

Clariant has described the move as a portfolio upgrade which will enable its strategy to achieve a "significant step change into higher value specialties" and increase value for stakeholders.

"We are getting the engineering plastics business from Sabic (for electric mobility, high-temperature high performance). It’s a good business with CHF2 billion (€1.78 billion) sales and we are combining this with our business, worth CHF1 billionn (€890,000). This we will grow from CHF3 billion (€2.6 billion) to CHF4 billion (€3.56 billion) in 2021,"said Hariolf CEO Kottmann during a conference call.

According to Kottmann, the move is to "create stability, not uncertainty" for Clariant and for the market.

"As we said when we were considering the Huntsman merger, you need a certain size to be successful in the chemical industry. This is first move in this direction. There is no [full] merger on our agenda today. But you can never exclude what a company will do in another 5-6 years," said the CEO, during the call in response to questions about the companies’ future.

Clariant will have the majority stake in the intended business combination. To that end, an equalisation consideration will be made by Clariant to Sabic, the amount of which will depend on the definitive valuation which is to be determined by both parties in the coming months.

The intended business will supply to a wide range of sectors, including smart electronics, health care, aerospace, automotive, robotics, additive manufacturing, renewable energy, and e-mobility.

The unit, Clariant expects, will have "superior ability" to meet customer specifications and provide technological advantages. This will create the basis for its accelerated profitable growth.

The combination of the two businesses is also expected to result in significant synergies with an anticipated annual run-rate of CHF100m (€89m), realised over three years from closing.

Sabic’s current business that is being merged with Clariant is the former GE Plastics. Headquartered in Amsterdam, this was acquired by Sabic in 2007 $11.6 billion in 2007.

The headquarters of the new JV has not yet been determined, but the two companies expect it to employ 700 once operational.

The Swiss chemicals supplier further clarified Sabic’s investment in the company, with the announcement of a new Governance Agreement which defines the Saudi company’s position as "a strategic anchor shareholder" in Clariant.

Under the new governance agreement, Clariant will continue its independence as a publicly-listed company under Swiss corporate governance.

At an extraordinary general meeting, it will be proposed to expand the Clariant board of directors from 10 to 12 members. Four of the board members will be nominated by Sabic.

Furthermore, it will be proposed that Kottmann will become the new chairman of the board, succeeding Rudolf Wehrli. Kottmann will resign from his position as Clariant CEO.

Sabic’s current specialities executive vice president Ernesto Occhiello has been appointed as new CEO of Clariant. "Clariant is a strong company with an impressive track record which will continue on its successful path with Hariolf Kottmann as the new chairman," said Sabic CEO Yousef Al-Benyan.

Speciality chemicals, Benyan said, are an important building block for Sabic’s strategy.

"We see ourselves as a responsible long-term oriented strategic shareholder, and the governance agreement underlines our commitment to create value for all stakeholders," he added.

In addition to the major collaboration with Sabic, Clariant also announced plans for divesting its pigments.