Sinopec ... spending more on upstream

Sinopec ... spending more on upstream

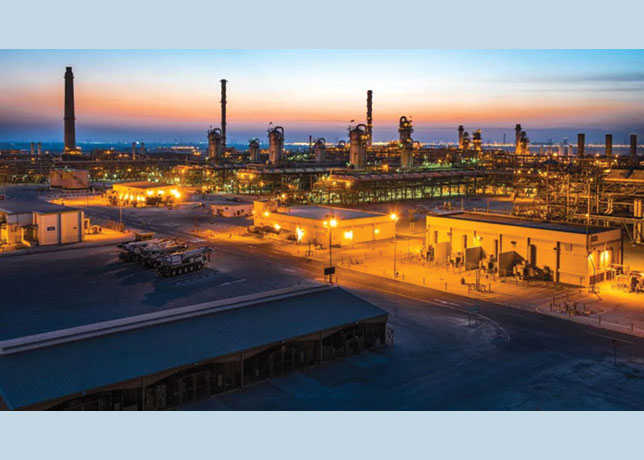

Asia’s top refiner China Petroleum & Chemical Corp (Sinopec) boosted spending on exploration and production by 41 per cent last year as crude oil reserves tumbled at its biggest oilfield.

Sinopec’s upstream capital expenditure rose to 59.6 billion yuan ($8.9 billion), its highest since 2014, as the company prepares to ramp up exploration at the Shengli oilfield and shale gas blocks in the southwestern Sichuan province.

The jump in spending was partially in response to Beijing’s call for energy security, while untapped proven crude reserve from Shengli fell to 16 million barrels by the end of 2018 from 49 million barrels in 2017.

Sinopec also came under more pressure to source cheap crude as it plans record refinery runs in 2019.

Its total cost for purchasing crude oil rose 41 per cent to 701 billion yuan because of higher global oil prices.

Sinopec plans to increase its crude processing rate to 4.92 million barrel per day (bpd), up from 4.88 mbpd last year.

Its gasoline sales volumes last year were up 4.9 per cent to 88 million tonnes, while diesel sales volumes dipped by 4.7 per cent. Average diesel prices, however, rose 19 per cent last year.

The refiner posted its smallest quarterly net profit since at least the third quarter of 2016 after its oil trading business Unipec registered one of China’s largest derivatives trading losses in nearly a decade.

Sinopec’s fourth-quarter net profit plunged 76 per cent from a year ago to only 3.1 billion yuan because of the one-off Unipec trading loss. Its revenue increased 33 per cent to 818 billion yuan in the period, according to Reuters calculations.

Sinopec said Unipec had a net loss of 4.02 billion yuan last year. Unipec lost 4.65 billion yuan on crude oil hedging in the fourth quarter.