Al Balwi ... positive outlook

Al Balwi ... positive outlook

The company’s new projects are focusing around the EPCI contractors, the military and dredging companies at a time when the market is tough

Despite tough market conditions, Dammam Shipyard, part of the Al Blagha Holding Group, put in a good solid performance in 2016 and is bullish about the company’s prospects over the coming years.

'While liquidity is still tight in the market, 2017 is definitely recovering,' says Fares Al Balwi, CEO of Al Blagha Group.

Although liquidity due to the lower oil and gas prices has had an effect on the market and many rig or vessel repairs have pushed back projects, Dammam Shipyard’s new projects are focusing around the EPCI contractors, the military and dredging companies, he says.

Thus the company’s major clients include oil and gas EPCI contractors with Saudi Aramco LTA agreements, commercial vessels and the Military (RSNF, Coast Guard).

Currently the company engages in the demolishing works of a production platform at Dammam Shipyard /as well as continuing to perform its core services for commercial vessels as well as RSNF and the Saudi coast Guard on both coasts.

With lower oil prices affecting business all over, the company’s strategy to combat it has been to focus on building a quality team, controlling costs but also continue to invest in equipment and people. To a question on what has been Dammam Shipyard’s competitive edge compared to other players in the market, he says by concentrating on client turnaround in a safe and effective manner and providing a good service the company has gained a competitive edge over it rivals.

|

|

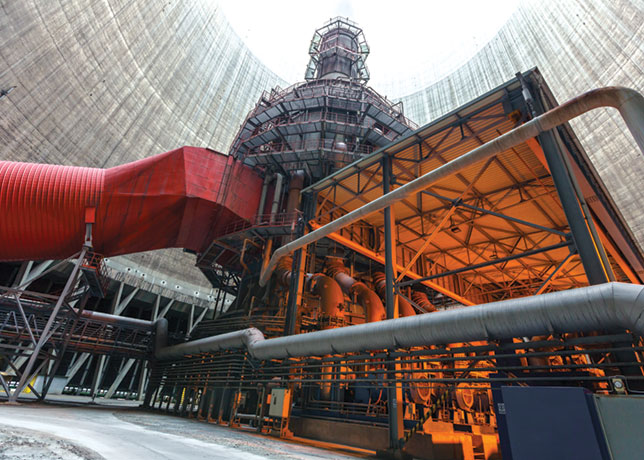

Dammam Shipyard facility |

On the effect that Saudi Aramco’s planned joint venture mega integrated maritime yard will have on Dammam Shipyard’s business, Fares says: 'I believe Dammam Shipyard will form part of the full Eastern Province Saudi Aramco Eco-system and complement the planned expansion. Our yards and facilities will offer support in terms of additional sites and trained qualified certified labour.'

To a question, he says shipbuilding is part of Dammam Shipyard’s plan, but growth will be in the military section of the Saudi market in accordance with the Saudi government plan to localise military shipbuilding. 'Ship and rig repair are starting to recover after lower activity due to lower oil and gas prices and we believe in-kingdom rig repair will continue to increase, as the pressure to localise repairs in the kingdom increases,' he says.

The company provides vessel and rig owners a fully equipped shipyard and berth access with a specialised in-house team of engineers in the Eastern and Western Provinces.

Dammam Shipyard has 600 m of quay and two floating docks up to 215 m, with fully equipped/certified workshops. Since February 2015 Dammam Shipyard has completed 12 fabrication and jack-up rig repair projects, he says.

Despite all companies within the marine, oil and gas industry being affected by lower oil prices, Dammam Shipyard has remained in demand thanks to its competitive edge as the closest shipyard to Saudi Aramco’s oilfields. Such close proximity means vessels and rig owners can remain in Saudi waters, thus saving time and money, as there is no requirement to cancel work permits or for vessels to go through custom clearance.

.jpg)